Cromwell Reit's assets were in Denmark, France, Germany, Italy, the

Netherlands and Poland at the time, and included a mix of fully and

partially-owned freehold and leasehold properties with differing

structures in different jurisdictions.

The IPO proceeds will be used to acquire 60 properties in Denmark,

France, Germany and the Netherlands from funds managed by Cromwell

Property Group for third-party investors, and 14 Italian properties from

independent third parties.

Saturday, November 25, 2017

IPO_SGX: No Signboard (S$0.28)

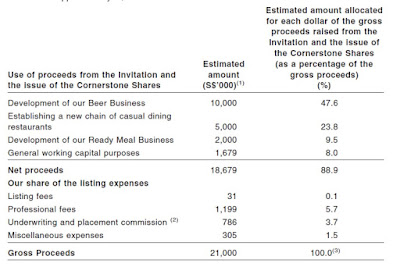

Seafood restaurant chain and brewery business group – No Signboard

Holdings is seeking a Catalist listing to raise up to $35mil. Based on

preliminary information, this could potentially value the company at

approximately $130mil.

The offering price values No Signboard at $129.5 million, and represents 13.9 times the company's earnings per share for the year ended September 2016.

The offering price values No Signboard at $129.5 million, and represents 13.9 times the company's earnings per share for the year ended September 2016.

Saturday, November 18, 2017

IPO_SGX: MINDCHAMPS PRESCHOOL LIMITED (S$0.83)

The company is the first

pre-school operator here to be listed on the Singapore exchange. It is

offering 30.4 million shares at S$0.83 each and the

company valued at S$200.5 million.

As at Oct 30, MindChamps has sold a total of 109 licences under unit franchise agreements and master franchise arrangements. Its preschool franchise licence fees in Singapore have increased from S$55,000 in 2008 to S$150,000 - which is “an endorsement by the market of the value of the MindChamps franchise”, the company said.

Counter: MCHAMPS

Offer price: S$0.83

As at Oct 30, MindChamps has sold a total of 109 licences under unit franchise agreements and master franchise arrangements. Its preschool franchise licence fees in Singapore have increased from S$55,000 in 2008 to S$150,000 - which is “an endorsement by the market of the value of the MindChamps franchise”, the company said.

Offer price: S$0.83

IPO_SGX: RE&S Holdings Limited (S$0.22)

Japanese restaurant group RE&S Holdings has priced its initial

public offering of 38 million shares at 22 Singapore cents a share.

RE&S is offering 38 million shares, with 35 million shares being placed and three million shares for public subscription.

The group, which owns and operates 72 food and beverage outlets in Singapore and five in Malaysia, has a portfolio of 20 brands including Ichiban Boshi, Ichiban Sushi and Sumiya, across full-service restaurants as well as quick-service ones and convenience.

Counter code: 1G1

Offer Price: S$0.22

-update- first day trade

Open: $0.355 (+ 61.4%)

Close: $0.31( +40.9%)

RE&S is offering 38 million shares, with 35 million shares being placed and three million shares for public subscription.

The group, which owns and operates 72 food and beverage outlets in Singapore and five in Malaysia, has a portfolio of 20 brands including Ichiban Boshi, Ichiban Sushi and Sumiya, across full-service restaurants as well as quick-service ones and convenience.

Counter code: 1G1

Offer Price: S$0.22

-update- first day trade

Open: $0.355 (+ 61.4%)

Close: $0.31( +40.9%)

Monday, November 6, 2017

IPO_KLSE: Kejuruteraan Asastera (RM0.25)

Offer Price: RM0.25

-Update- First trade day

Open : RM0.305 (+22%)

Close: RM0.300 (+20%)

IPO_SGX: KBS Keppel US REIT (US$0.88)

Offer Price: US$0.88

-Update- First trade day

Open: US$0.895 (+1.7%)

Close: US$0.895 (+1.7%)

Sunday, November 5, 2017

原油熊市將再持續五到十年,徘徊在每桶30至60美元

富國銀行表示,雖然素來是熊以冬眠著稱,但在石油市場裏,可能牛市將要迎來漫長冬眠。

如果這個看法是正確的話,那麼WTI原油的上漲空間不大,其本周三距離2017年高點55.24美元隻差2美分。

Pickle表示,超級周期的熊市一般持續20年,但現在可能不會持續那麼久。如此長期的下滑已經是上個世紀的事情了,最後一個商品超級周期的熊市從1983年一直持續到1999年。

Pickle指出,熊市之所以持續這麼久是因為在牛市過度之後,石油生產商持續削減成本,優化投資,只有成本效益最高的石油生產商能夠脫穎而出,其他剩下的公司只能在低價原油的環境下生存。

由於美國已經能從頁岩岩層中提取石油和天然氣,造成了原油產量洪水時期,這使得原油價格從2014年的每桶超過100美元暴跌到2016年2月的每桶26美元。

Pickle指出,大宗商品市場熊市是牛市期間人類行為造成的結果。原油價格上漲引發人們投資開發新技術(例如頁岩油開採),這將導致生產不斷增加,最終供大於求造成熊市。

熊市現在已經完成了愈合過程的第一步:淘汰最弱的玩家。 據富國銀行數據顯示,大約有22%的勘探和生產公司在這個階段破產,1986年的石油價格崩盤時則有約26%的公司破產。

Pickler警告稱,愈合過程的第二步:原油價格停止在某一區間,這一過程可能會持續好幾年。之前的熊市超級周期,從1986年的原油價格崩盤到1999年新牛市開始,一共歷時12年,目前低迷的原油市場走勢也是跟隨該走勢。

最後一步就是爆發:當公司和投資者多年來承受極低的利潤甚至是毫無利潤時,鑽探平台將被關閉,投資者另尋機會。隨著原油行業的投資減少,對其需求將逐漸超過供應,那麼新牛市將再度誕生。

Subscribe to:

Comments

(

Atom

)